Franchise Investments with Kim Daly

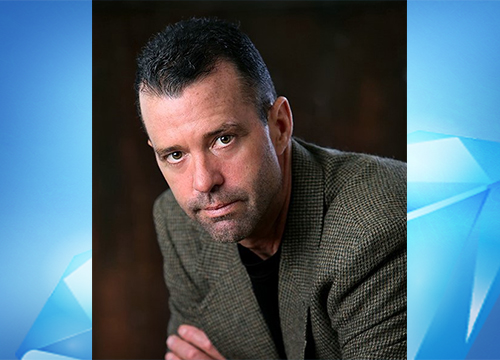

Guest: Kim Daly is an independent franchise consultant with FranChoice. She is also the co-author of Franchising Freedom & Mission Matters Volume 5, Top Tips to Success.

Big Idea: Kim Daly is an expert in franchise investment. Kim Daly has spent the last 20 years helping people achieve financial freedom by enabling them to find the perfect franchise opportunities. Her skill for matching a client’s background, interests, skills, finances and life goals to the ideal opportunity has made her one of the top franchise consultants in the country. On today’s episode we discuss the way some real estate investors transition from house flipping to owning a portfolio of franchise businesses-which might be a great solution in today’s low inventory real estate market. We also discuss the process of getting started and then building to scale, where you reap the real rewards of the franchise business.

Dan: Love it. I found a quote online. I think this would be a good place to start. I don’t know if you wrote this or someone wrote it about you, but it said “She worked as a personal trainer and had medical school dreams before entrepreneurship and franchising found her.” Tell me about that.

Kim: That is all true. In franchising, Dan. The question that’s commonly asked is, how did franchising find you? Because nobody really wakes up and says, “Oh yeah, I think I’m going to go get into franchising.” Right? It’s more like you’re looking for some outcome in your life and you stumble upon the advantages of franchising and go, “Ooh, this is a way to get where I want to go.” That’s pretty much what happened to me. There were two things I wanted to do when I was young. One was to become a motivational speaker, but like, how does one do that? You pursue the more logical thing. I was a straight-A student. I’m going to go to medical school and help people. Like I just always desired to be a person of influence, to do something that genuinely improves the lives of other people.

After undergrad, I answered a classified ad in the newspaper that was for a franchise consulting company, not the one I’m part of today. But literally, that classified ad changed my life when I found what franchising as an industry is and does for people, which is, it’s an industry of people helping people. It’s an industry where every single day people are realizing their dreams, living their dreams, just inspiring, and helping each other. I knew that I had found my homeland. I did make a temporary deviation into entrepreneurship because like every good business owner, I think we all think that we can go out there and do it on our own. I tried to do that for five years and figured out how hard it is and mainly how lonely it is and the things that I now help other people realize and learn about in franchising like that.

In a franchise, you’re in business for yourself, but not by yourself. You have the comradery of, not just a corporate office, but all of the other franchise owners that are out there that are part of this brand. Together you are building something. It’s like people who go off to war together often talk about the part they miss about being in the military is the comradery, right? People that go through an intense situation together in anything in life, they’ll reflect back fondly on the people that they went through that experience. Like if you’re bringing a company up to an IPO, right? I think the same thing is true in franchising. We’re all trying to achieve our own individual dreams, but collectively we’re coming together to build a brand altogether and so it has that same sense of camaraderie. Once I came back to entrepreneurship at the very old age of 29, I’m sorry, but once I came back to franchising at 29, I never left. I’ve spent 20 years now as a franchise consultant.

This Episode of The REI Diamonds Show is Sponsored by the Deal Machine. This Software Enables Real Estate Investors to Develop a Reliable & Low Cost Source of Off Market Deals. For a Limited Time, You Get Free Access at http://REIDealMachine.com/

This Episode is Also Sponsored by the Lending Home. Lending Home Offers Reliable & Low Cost Fix & Flip Loans with Interest Rates as Low as 9.25%. Buy & Hold Loans Offered Even Lower. Get a FREE IPad when you Close Your First Deal by Registering Now at http://REILineOfCredit.com

Resources mentioned in this episode:

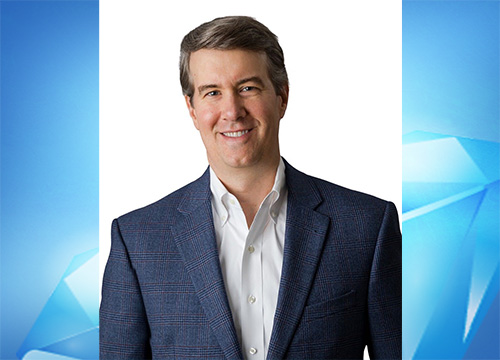

How to Invest in a Franchise Business with Jon Ostenson

For Access to Real Estate Deals You Can Buy & Sell for Profit:

https://AccessOffMarketDeals.com/podcast/

Kim & I Discuss Franchise Investing:

-

Is Franchising Safe in an Uncertain Economy?

-

Why does Franchising Grow in Challenging Times?

-

How to Find the RIGHT Franchise for You

-

Best Franchise Opportunities in the Market Today

Relevant Episodes: (There are 208 Content Packed Interviews in Total)

- Virtual Wholesale Real Estate Investing with Brandon Barnes

- Economic Forecast 2021 with Paul Sloate

- Jason Balin on Funding Flips in the 2017 Market

- How to Rehab a House the RIGHT Way with Van Sturgeon

The transcript of this episode can be found here.

Transcripts of all episodes can be found here.