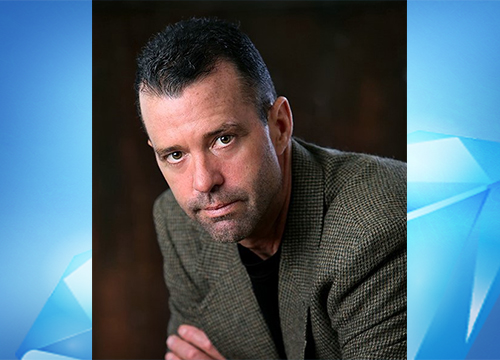

Rental Property Insurance Pitfalls with Attorney Galen Hair

Guest (Attorney Galen Hair): New Orleans Attorney Galen Hair is an expert in avoiding rental property insurance pitfalls. At any given time Galen and his team are involved in helping several hundred people obtain full payment from insurance companies for catastrophic loss.

Big Idea: Rental property insurance policies are designed NOT to pay out. Galen Hair & I discuss the process for purchasing a property insurance policy. I personally own dozens of properties and have flipped well over 1,000, and I’ve NEVER bought insurance with the level of due diligence coached by Galen. You may not have the insurance protection you believe you bought….

Dan Breslin: Today we are joined by New Orleans Attorney Galen Hair who is an expert in avoiding rental property insurance pitfalls. At any given time, Galen and his team are involved in helping several 100 people obtain full payment from insurance companies for catastrophic losses. A catastrophic loss would be considered a very large claim usually a fire in the context of us real estate investors. The thing is, many rental property insurance policies are actually designed not to pay out completely in those catastrophic events.

During this episode, Galen and I discussed the right process for purchasing a property insurance policy. I personally own dozens of properties and have flipped well over 1000 and I have never bought insurance with the level of due diligence coached by Galen on today’s episode, you may not have the insurance protection that you believe you bought. Let’s begin.

Alright, welcome to the REI diamond show. Galen, how are you doing?

Galen Hair: I’m great. How are you doing?

Dan: Nice. I am also great. We had like 60-degree weather here. It’s December in Chicago, which is unique for us this time of year. So no one’s complaining about the weather right now. Whereabouts are you recording in from and live and invest in that kind of thing?

Galen: Yeah, so our office is based in New Orleans. Essentially, that’s where I live. Spend most of my time here. Unfortunately though, given my line of work, I kind of have to follow disasters where they are. So I will move around, probably head to the Midwest next week because of some tornadoes that just kind of blew through everything during hurricane season, I kind of moved from Hurricane to hurricane but most of my life and work are in New Orleans. And the weather is crazy in New Orleans if anyone follows that. So I think today, it’s pretty good. It’s like 65. But a couple of days ago we were in like the 30s. So it’s just all over the place.

Dan: So just to kind of give people a little bit of background, if you would touch on maybe some of your real estate experience, and then kind of encapsulate what it is that you do in your business model now and how that fits in for real estate investors listening.

Galen: Yeah, so real estate-wise, I’m definitely an amateur. I do identify properties that make sense for us to pick up kind of in and around the New Orleans area. And what I’ll do is buy those, fix them up and actively rent them out. I find that that’s an easier model for me than flipping, although the markets are pretty good here. It produces revenue. So for me, as long as it’s cash positive, it’s an investment that I’m kind of interested in. But I don’t do more than maybe two a year.

This Episode of The REI Diamonds Show is Sponsored by the Deal Machine. This Software Enables Real Estate Investors to Develop a Reliable & Low Cost Source of Off Market Deals. For a Limited Time, You Get Free Access at http://REIDealMachine.com/

This Episode is Also Sponsored by the Lending Home. Lending Home Offers Reliable & Low Cost Fix & Flip Loans with Interest Rates as Low as 6.99%. Buy & Hold Loans Offered Even Lower. Get a FREE IPad when you Close Your First Deal by Registering Now at http://REILineOfCredit.com

Resources mentioned in this episode:

For Access to Real Estate Deals You Can Buy & Sell for Profit:

https://AccessRealEstateDeals.com/

Galen Hair & I Discuss Rental Property Insurance:

-

Rental Property Insurance Policy Pitfalls-written to avoid paying claims

-

How to Make a Claim in the Event of Catastrophic loss

-

Choosing Enough Coverage When Buying a Policy

-

The Sneaky Practice of “Co-Insurance”

Relevant Episodes: (There are 205 Content Packed Interviews in Total)

- 100+ Unit Apartment Syndication with Stephanie Walter

- Making, then Losing $50 Million with Rod Khleif

- REI Diamonds Show with Michael Freedman on Verifying, Reducing, or Even Eliminating Flood Zone Designations on All Kinds of Real Estate

- Andy Shamberg on Property Insurance Fundamentals

- Probate Leads, Data, & Real Estate Deals with Bill Gross