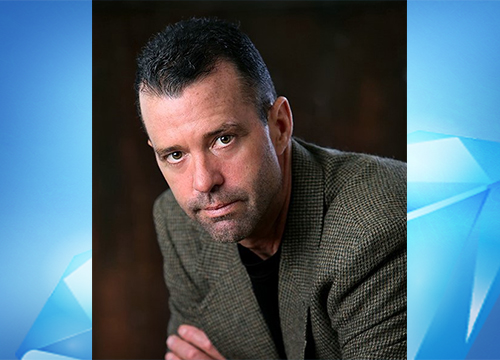

Fast & Easy Multifamily Lending with StackSource Founder Tim Milazzo

Guest: Tim Milazzo is the co-founder of StackSource, a technology driven engine for funding commercial real estate deals of all types.

Big Idea: Having access to fast & easy multifamily lending, or any other commercial funding, is the first step to scaling a multi-million dollar real estate portfolio. The commercial loan landscape is extremely fragmented, with many lenders focused on only certain asset types, loan sizes, or other niche spaces at any given time. StackSource is a national high volume aggregator of lenders, loan types & contacts, providing borrowers the faster method for finding the correct lender for your particular asset type.

Tim & I discuss how this volume of lenders will put you in a position of strength when you’re funding a deal. Obtaining multiple, competing loan term sheets can be difficult when you’re buying a commercial deal because of the short timeline to closing.

The StackSource platform allows you to provide details of your project-whether multi family, industrial, commercial, etc- and then matches your loan type with those lending institutions currently lending in your local market and funding your specific deal type. The end result is multiple term sheets allowing you to select the best option for your deal.

This is a contrast to how I’ve bought my last half dozen multi family projects: calling around asking people I know who is funding this type of deal-then submitting my deal details to that single lender and obtaining one term sheet. My way is a position of weakness-I am stuck riding with that single lender on that deal. It’s worked out for me because I’m lucky to have found the right lender for my type of loan. Shall we begin?

Dan Breslin: Welcome to the REI Diamond Show. I’m your host, Dan Breslin, and this is episode 206 on fast and easy multifamily lending with StackSource founder, Tim Milazzo. If you’re into building wealth through real estate investing, you are in the right place. My goal is to identify high-caliber real estate investors and other industry service providers, invite them on the show, and then draw out the jewels of wisdom. Those tactics, mindsets, methods used to create millions of dollars more in the business of real estate. Having access to fast and easy multifamily lending or any other commercial funding is the first step to scaling a multimillion-dollar commercial real estate portfolio. The commercial loan landscape is extremely fragmented with many lenders focused only on certain asset types, or certain loan sizes, or other niche spaces at any given time. StackSource is a national, high-volume, aggregator of those lenders, loan types, contacts, etcetara, providing you, the borrower, with the faster method for finding the correct lender for your particular asset type.

On today’s episode, Tim and I discuss how this volume of lenders that StackSource has aggregated will put you in a position of strength when you are funding a deal. Obtaining multiple competing loan term sheets can be difficult when you’re buying a commercial deal because of the short timeline to closing. It’s multiple calls to the lenders that you’re googling and they don’t do this kind of asset type, etcetara. Whereas the StackSource platform allows you to provide the details of your project, whether multifamily, industrial. commercial, etcetera, and then matches your loan type with those lending institutions currently lending in that local market and funding your specific deal type. So, the end result is a multiple term sheets allowing you to select the best option for your deal, and then proceed with a complete loan package. And this is in contrast to how I bought my last half dozen multifamily projects which was going around, asking people I know who is funding this type of deal, and then submitting my deal details to that single lender, and obtaining a single term sheet. So, I kind of had no other options if that lender did not work out, and I didn’t really have the ability to shop the deal due to lack of time and lack of contacts. Whereas I didn’t have access to this platform.

So, my way was a position of weakness and I’m stuck riding with that single lender on that deal. Now, luckily, it worked out for me because I found just the right lender for just the right loan type who lends in my market but that’s not always the case, and the challenge can be even greater if you’re investing all over the US.

This Episode of The REI Diamonds Show is Sponsored by the Deal Machine. This Software Enables Real Estate Investors to Develop a Reliable & Low Cost Source of Off Market Deals. For a Limited Time, You Get Free Access at http://REIDealMachine.com/

This Episode is Also Sponsored by the Lending Home. Lending Home Offers Reliable & Low Cost Fix & Flip Loans with Interest Rates as Low as 6.99%. Buy & Hold Loans Offered Even Lower. Get a FREE IPad when you Close Your First Deal by Registering Now at http://REILineOfCredit.com

Resources mentioned in this episode:

For Access to Real Estate Deals You Can Buy & Sell for Profit:

https://AccessOffMarketDeals.com/podcast/

Tim & I Discuss StackSource & Multifamily Lending:

-

Hottest Sectors in Commercial Real Estate

-

How to Finance Multifamily Investments

-

Obtaining Fastest Rate & Term Quotes

-

Finding Commercial Funding Anywhere in the U.S.

Relevant Episodes: (There are 206 Content Packed Interviews in Total)

- Joe Mueller, REO Broker & Investor on Picking the BEST Deals for Your Portfolio

- John Matheson on How to Access Commercial Credit

- Dan Breslin on Raising Private Money for Single Family Flips

- Dave Orloff on Financing Rentals & Fix & Flip Deals