Matt & I Discuss

-

How to Raise Millions of Dollars in Private Money

-

Changing Your Mindset to Level Up to Larger Deals

-

Capital Structure of a Multi Family Deal

-

How Much to Offer Investors to Fund Your Deal

Listen Now:

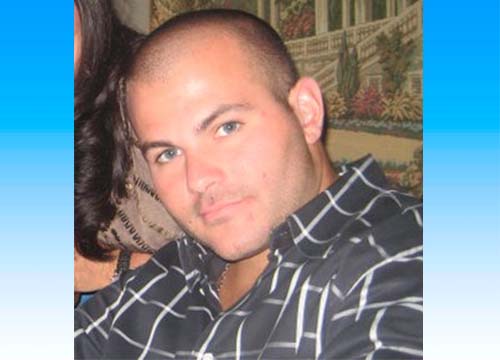

Moving Up from Flipping Houses to Flipping Multi-Family

Matt started out buying a duplex outside of Philadelphia with a $30,000 private loan. He has since built an empire including a portfolio of rental houses, a house flipping division, and most recently a multi-family value add division buying and stabilizing properties throughout the U.S. He has a cutting edge method of raising capital allowing him to quickly commit and fund millions of dollars in just a few weeks.

Relevant Episodes: (There are 118 Content Packed Interviews in Total)

- Russell Walker on $45K Per Month with Airbnb

- Austin Stack on $1 Million Dollars in 14 Months

- Joe Fairless on Scaling Up to 3,500 Units

- Michael Quarles on Closing More than 1,000 Deals Across the U.S.

Resources Mentioned in the Episode:

Do You Know Anyone Else Who’s a Real Estate Investor?

Do You Think they’d Also Enjoy this Episode?

Please Forward this Link & Tell Them to:

Sign Up for the REI Diamonds Weekly Podcast Your Copy of “Become a Wholesale Real Estate Master”

Just Go to www.REIDiamonds.com to Download a Copy & Check out Recent Popular Episodes.