Guest: Chad Fowler is an architect specializing in data center design at HED Design part of the mission-critical team which is dedicated to advancing technology integration and implementing sustainable practices. Chad emphasizes the importance of educating communities about the significance of data centers in the digital landscape. His work aims for a better understanding of how data centers support modern technology and infrastructure.

Big Idea: Chad discusses the evolution and significance of data centers in supporting modern technology, particularly in the context of AI advancements, and argues that their crucial role in the digital age requires innovative design and community engagement.

This episode is also sponsored by Lending Home. Lending Home offers reliable & low-cost fix & flip loans with interest rates as low as 9.25%. Buy & hold loans offered even lower. Get a FREE iPad when you close your first deal by registering here now.

Resources mentioned in this episode:

Chad Fowler & I Discuss Data Center Development:

- Data Center Definition and Evolution (00:11 – 00:30)

- Power Consumption and Cooling Technologies (00:49 – 01:20)

- Impact of AI on Data Center Design (05:45 – 06:08)

- Community Education and Sustainable Practices (42:20 – 43:10)

Relevant Episodes: (200+ Content-Packed Interviews in Total)

- How to Make $300K/Year Investing in Mobile Homes with No Money Down

- How to Make $100K or More Per Deal with Tucker Merrihew

- Unlocking Multifamily Millions: How Vlad Arakcheyev Transformed from Graphic Designer to Syndication Powerhouse

- Chris Prefontaine on $75,000 Average Profit Per Deal

—

Watch the episode here

Listen to the podcast here

Data Center Development With Chad Fowler

Mr. Chad Fowler, welcome to the REI Diamonds show. How are you?

I’m great. Thanks for having me, Dan.

You’re with HED Design and on the mission-critical team, which is mostly focused on data center design throughout the US and around the world. What’s the deal with that?

We’re primarily US-based. The global market is there, and it’s something that we have done a little bit of work in future expansions.

This will be a little bit of a diversion from probably a lot of the topics that we have on the show here, but I think this fits for a few reasons. Number one, we’re talking about real estate development. I’d argue one of the most niche values, I would probably guess this is the highest value per square foot transactions that we saw in 2024 and 2023, if I had to guess, on a price per square foot basis. I think $2,300 a square foot was one traded in Elk Grove Village, which our Chicago audience will know that name, but maybe not so much the rest of the folks around the country.

We have real estate development, high-price niche real estate that we normally probably don’t look at. I thought this was an interesting topic. I’m hoping we can get a nice little overview of the industry on our show episode. Chad, what else did I miss from the short introduction here that might help fill in any holes?

I’ll expand a little bit. I am an architect by training, so my background is in architecture. HED is an interdisciplinary company concentrating on advancing our world. It is where we focus on positive impact and the future of what we can offer to our built environment and our communities.

Data Center Definition And Evolution

Why don’t we start with defining a data center? What is a data center? Maybe you’re defining one in the last 18 months because I’m betting that this industry has moved a whole lot in the 20 or 30 years that you guys have been designing these things.

It certainly has. It’s a whole different world now than when it started. It’s a very exciting time. We are interacting with a data center as how you and I are talking virtually. Our everyday lives are becoming connected to data centers the more and more technology we use. That’s driving this rapid expansion in the market and a lot of other factors. What are they? They are information storage locations, and they are information hubs, transferring from one location to another location. They are areas that do calculations. They are areas with AI.

Our everyday lives are becoming increasingly connected to data centers as we use more and more technology. This, along with other factors, is driving the rapid expansion in the market.

Let’s jump to the AI. AI learning, AI calculations, and AI data are all stored, developed, and figured out in a data center. They can be large facilities. They can also be small facilities. Every office function has a need for some small or medium data center component. They can either be housed by themselves and operated by themselves, or they go to co-location providers, which are larger facilities, and they become part of that larger infrastructure.

On the small end versus the large end, in the number of square feet, talk real estate. What are we thinking? Is it 200,000 on the large end?

That’s a decent-sized medium building, 200,000 square feet. The smaller ones could be 10,000, 20,000, or 50,000 square feet. That’s on the smaller side. Larger, you’re getting into up to a million square feet in there. The power consumption of those is astronomical when you think about it. The 200,000-square-foot building you’re talking about, 2 or 3 years ago, we’re looking at 36 megawatts of IT load. That’s infrastructure load. That is the power that is going to the servers, which is what is housed within the data center.

On top of that, you have to add all the power that is associated with cooling. As you’re using that power, the generator generates a significant amount of heat, and you have to provide the cooling in order to heat-reject that and the overall loads within the building. For 36 megawatts, you’re looking at 36-plus megawatts for total power consumption within that building. It depends on the efficiency you have there.

If we were to put that in context, what is that? Is that 600 houses’ worth of power?

You’re talking about towns. This is going into a 200,000-square-foot facility. When you look at that all within a spot, that is an enormous amount of power.

That was 2 or 3 years ago, you said. What about now?

We’re now getting to the point where we’re not even sure how much power we can fit in that 200,000 square feet. AI has changed our environment and our world to be something completely different. You hear a lot in the news about NVIDIA, what they’re doing, and what some of these companies are producing. Their rollouts are taking an enormous amount of power and putting them in a very small square footage space. If we take that 200,000-square-foot building, 36 megawatts in there, you’re almost doubling that power to that same square footage.

AI has really changed our environment and our world, making them completely different.

The challenge that it is driving is how do you take all that electricity and that heat that is generated in a smaller footprint, and how are you handling that? Historically, that was done by air distribution going over the servers and air management. The supply air, which is cooled, is forced through the inlet of the servers. It is then separated as it comes out the back of the servers, which is the hot air, and that recycles back into the server.

You can get into the servers. In an individual server, it is roughly 2 feet by 4 feet, and it can vary. Let’s say it’s 8 feet tall. That’s one server. One server was historically somewhere between 8 and 10 KW per cabinet. That same cabinet, that same footprint, instead of that, let’s say the high end of this is 10 KW power, we’re looking at 30 KW, 40 KW, 50 KW, or even more.

Mostly, that’s the AI trend, and NVIDIA’s new chips and that kind of thing that we hear a lot about.

We’re hearing all about those. Those are facilitating the ability in order to do all that compute power in such a small area and so efficiently. In order to get there, you’re providing a liquid-based, or some transferable-based, cooling medium that is transferred, and it’s going directly into the servers or the individual pieces within that cabinet, which is a 2-feet by 4-feet piece. It’s going directly into there, and in some cases, directly to that chip to provide the cooling exactly where you need to provide it at those densities.

It’s almost following the trend of the automobile. I think the early Henry Ford Model T’s were air-cooled. You got a radiator in the car, and you’re using antifreeze and a water pump, and you got the radiator in the front catching the air, going with a liquid base. That’s amazing. That computer power now requires that technological leap.

Think about you sitting in a computer. That computer is going to have a bunch of wires for your power and your connectivity to the outside world and provide a couple of other connections, and some sort of liquid is going in there to cool what’s inside your small little computer at your desk.

The Future Of Nuclear Power In Data Centers

That’s wild. We have a challenge too. You’re generating all this power. I remember a few years ago, I read something, I can’t remember if it was a book or what, Bill Gates probably 5 or 7 years ago. I remember he was pitching the platform of nuclear power. We’re going to run out of energy. I’m thinking to myself, electric cars are coming, and I get where he’s coming from. What a nice guy that he wants to get us on nuclear so that we could have plenty of power for our air conditioner, and refrigerator. I’m coming to the realization he knew AI was a thing.

They had data centers everywhere. Microsoft is one of the most cutting-edge companies, certainly in tech, and maybe in the world. I’m like, he saw this coming, and we need nuclear power to power these data centers. I guess it was more of a business initiative on his part. Do you think that package nuclear power plant facilities are in our future here in the next 5 to 10 years, where a data center is now going to have its own uranium pellet that’s providing this kind of power?

It’s an interesting thought. Yes, in the short term. I think if not that, it’s going to be something similar to that, that we see happen. You’re seeing the large tech companies such as Microsoft and others. They’re looking at acquiring locations and restarting nuclear power plants. That’s simply within the northeast. What you were talking about is the small nuclear reactors, the module pieces that could be located in locations.

That is a hot topic. I think there are a lot of regulations that need to be figured out. Also, how do you get those in certain locations and jurisdictions? How does the community understand what it means to have that? It’s a scary word. I grew up in the 20, 30, 40, or 50 years ago. That was certainly something that was not necessarily viewed as positive.

Still enables if Fukushima went a few years ago, and that was a big deal and scary, and still is scary. It’s still scary to think we would have these little trailers dropped off with little miniature nuclear devices, and that’s going to be powering, not my backyard.

I mentioned Bill Gates and what he’s doing. It’s evaluating new technology and how that can be safer than what it was historically how we’ve been using it, and what our views are on that. I don’t know a lot of information about it. Somewhere in the West, I think the Wyoming area, he’s rolling out a trial of that technology. That’s my belief. I believe that when that happens, I’m assuming that it will help open the doors for more of that to come.

I think this had to do with using the spent rods from the nuclear facilities, which is a big problem, and storing those in New Mexico in some mountain somewhere. We’re going to run out of place to put that stuff. This new technology is supposed to recycle that. We’re out on a limb calling nuclear a green technology. I think it glows green, so we do have that.

They all have their upside and their downside. It’s the technology that’s not fossil-fueled that can efficiently provide the power that the country is looking to move into. As we move off fossil-fuel-driven appliances, cars, and all that stuff, the power still has to be generated in some fashion in order to get it to those points. The advancement in that technology or other technologies is going to be vital in order to keep going.

Green Design Innovations In Data Centers

That must happen. While we’re on the green topic, are there some green design techniques that maybe were developed in the last 2 to 5 years, that you guys have installed in data centers that might be helping with the problem of the pooling, the large amount of power, maybe the way that the properties look?

There’s a lot of that going on. It’s hard to point to one specific thing. I will say the data center market uses an enormous amount of energy. There’s no ifs and buts about that. What you want to do is make the usage of that energy as efficient as possible. There’s a metric that is used in the industry called PUE. The PUE measures the amount of power that goes to the building and then the amount of that power that is used for IT, the end source, and the servers.

Historically, if you’re looking back 20 or 30 years ago, you were looking at facilities that PUE was two-plus. Meaning for every amount of power that was going to the server, you were using that same amount of power to your building and cooling technology. Two is not a good number. One would be all the power going to that building is going straight to your IT. We’re now designing the facilities that are much closer to that one.

That’s 1.2. A little bit below that is 1.15. You can see where we started and where we currently are. Ideally, somewhere we’ll get into below one and where we’re generating power and pushing it back. How do we get there? How does sustainability come into that answer? The market drives a lot of research, and a lot of motivation to make that more efficient. Cooling technologies.

The advancement over the five years of how efficiently the cooling technology is distributing that air to the servers, and functionally how much power it takes to make those work, has grown substantially. The large tech companies, and the large REITs that are developing, are all working with manufacturers in order to help those manufacturers develop equipment that operates the most efficiently that it can. That means more money for your development.

At the end of the day, you’re saving money on the operations and overall. Other aspects of technology certainly in sustainability is with the building itself. I think there’s more of a concentration to make buildings themselves, either some LEED level, higher carbon footprint, evaluating how all that goes into the buildings, what material you’re using, and what’s the efficiency there.

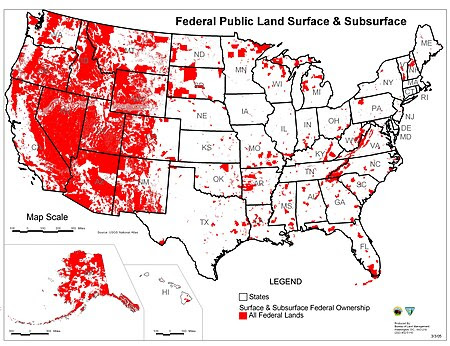

Also, location. Location becomes a big driver, geographic location. The power you’re going to ultimately utilize, where does that come from? Pacific Northwest, there’s a lot of hydropower up there. There’s the good and bad of hydropower, but it’s generally a green power source. We’re talking about nuclear before if it’s nuclear sourced. By far, most of it is still fossil fuel-driven.

When we talk about the location, you can’t put these out in the middle of Wyoming either. Don’t they have to be near the population base due to distance? With the technology for data transfer, can it be halfway around the world, and it doesn’t matter?

It’s what’s happening in the data center. Some of the AI stuff that’s going on can be in the middle of Wyoming because it’s self-perpetuating. It’s working within itself, and then it’s sending information out. It’s not as critical latency, which is how much time it takes the information to go from that server to you. There are things that are latency-dependent. At night, if you’re going to log on to Netflix and you want to start up your movie, you don’t want to sit there and see that wheel spinning for even ten seconds. You’re going, “What’s wrong?”

Not even three seconds.

That’s an eternity. Those are the areas where you want that proximity to be vital. Certainly, if you get to the financial world, the stock market, getting milliseconds is critical as well.

In the financial world, stock markets operate where milliseconds are critical.

You mentioned that AI can be slightly latent. I think we’re forgiving because AI is a new technology. You go on and you do deep research in AI, Gemini, and Google’s version. You set up your prompts, and then 5 to 10 minutes later, you get back to this nice report. That report probably could have been done by McKinsey or something and probably would have taken 30 days. We’re willing to wait eight minutes for that now, but what’s that going to look like five years from now? Is it going to be like a dial-up modem, and all of a sudden, it’s Wyoming AI data centers? Who’s going to rent that? That thing’s bankrupt. What idiot thought that was a good idea?

One thing on AI, I took a call. I can’t remember what the call was, but I remember thinking there was a big pregnant pause. I think this is AI. It felt like latency. I didn’t ask it if it was AI, but the voice sure sounded robotic. It was some confirmation call, a customer service thing. Somewhere AI certainly would be plugged in. It got whatever I was looking for done because I don’t remember being frustrated at the end. I remember thinking there’s this odd long pause. Maybe that’s the latency of the distance to the data centers that they’re using now.

It could be. Unfortunately, I answered a robocall the previous day because I was thinking it was something else. I had a similar experience where I started to say hello, and then there was a pause. I’m like, “Maybe no one’s there.” Someone started to talk, and then I responded, and then there was the pause, and I was like, “Talking to a machine.” Certainly, in the future, that’s going to change. It’s got to change. There’s going to be some prompt. There’s going to be a point where we’re not going to know what that is.

I think AI is a huge boom and how and what we use it for. I don’t even think we know how we’re going to ultimately use it yet. I’m sure somebody does, but it’s going to continue and continue and continue to improve as it develops. The data centers that we’re doing now are facilitating those AI to become what it will be in the future. There is a learning environment for AI. It’s not our learning, per se, but it’s got to have that data. You’ve got to feed that data into it in order to be able to understand it.

The current boom in AI is significantly changing how and what we use it for, but its ultimate uses remain unknown.

Are We At Peak Data Center Development?

You’ve been present and operating as an architect for the past 30 years, which was what you mentioned before we started the call. That would have put us through the dot-com boom and bust, and we’re in the AI boom. I wonder from your perspective, with the number and size of centers and the money that’s thrown around for these things, I believe they overbuilt the data centers in 1996, 1997, 1998, 1999, 2000.

They were building and building way more capacity than we needed up until about 2003, 2004, and 2005 when video finally came online, suddenly we didn’t have enough capacity anymore. Do you feel we’re at the peak of data center development yet, or maybe I’m totally off base, and we still have such a humongous runway to go and it’s unexplainable.

I think about the dot-com days and when it’s coming again. I don’t think we’re there yet. I think that was way before its time, the dot-com boom, as we saw, it was prepping for something that wasn’t happening at the same pace. My understanding of the people that are driving this market, what their plans are over the next year, and the amount of money that they’re pouring into this is mind-boggling and will continue to grow for the foreseeable future. It is going to change. When will that happen? I don’t know, but it’s not going to be certainly in the next five-plus years.

I guess we should all buy more NVIDIA stock then, is that it?

I know, yeah. That’s starting. There’s going to be more of them. They’re starting everybody. Others are developing it. Where we are in the data center development and what that means is we don’t understand what that means to the buildings still. In order to deploy an NVIDIA lineup, you’re going into a 60,000-square-foot computer room. That’s what we call white space, where historically, there would be lines and lines of cabinets and servers.

You’re going to a room, and there’s 10% of that room being utilized for the NVIDIA servers. That’s it. It’s a big, empty space. How we plan and how we plan the buildings and how we make these buildings more efficient is something that is coming and will start to happen over the next few years as we see how we can provide all the backbone of the equipment and get that cooling and that power to such a small space.

How big is the actual building? Is it 80,000 feet to make a 60,000-foot white space?

What I say is 60,000 square foot white space, there could be six of those within a 200,000 square foot building. That one would have less than six of them.

Ten percent is the NVIDIA build-out. Is the rest vacant for future expansion?

It’s vacant because there’s no additional power to be used there. That’s an extreme event.

We’re not building a bunch of empty data centers as we speak. That’s not happening.

It’s what’s driving change in the industry. It’s exciting to see what’s going to happen.

The Business Model Behind Data Centers

Would you mind breaking down the owners? We mentioned REITs, and we think REITs are renting out the space. Are we talking 200,000 square feet, and the whole thing is rented to Amazon web servers? They probably are building their own for AWS, and they are 100% full, but what’s the makeup of a 200,000-square-foot building with 360,000 square-foot white spaces? Are they all one tenant, or are there seventeen tenants? What’s the business model behind the scene if you know?

It’s any and all above to be. Large tech companies like the Amazons and the Microsofts of the world are expanding so fast that they’re building and operating their own facilities. They’re also going to these REITs and taking an entire building that they’ve built and developed just because they can get that online faster than they can develop their own buildings.

That’s the speed of the market that they’re working under. That’s a big impact that’s happening there now. Historically, there’s a mixture. I think different companies have different philosophies on how to do that. There are a number of REITs that develop that and then they lease. It’s very much co-location. They’re either leasing cabinet space. It could be one cabinet for a client. It could be ten cabinets in a room that could house 1,000 cabinets.

There’s a breakdown of that. In between that, you have companies that need the computing power of 6, 8, or 10 megawatts of power, and they lease the entire room. That’s all the room in order to do what their requirements are. Any and all above. By far, the biggest impact is from those large tech companies there, where you’re taking old buildings down. That’s the ultimate goal in that world.

Do they built on spec and then they put them out as a co-location? Microsoft is like, “We need it all. Here’s a lease.” Is that how they’re going down?

Kind of. You might have to tweak it. You might have to make some adjustments because the kit that they put in there, which is all their servers and things, might need to have a few different requirements than what that spec build has. You might have to make some modifications.

That would be the developer or the owner of the building making those modifications on their dime. Now Microsoft comes in and will take that for a 5 or 10-year lease, something like that. I guess one of the risks if I’m the developer and I build a site, some new chip could come in. AI could design a better version of itself in a utopian world. Suddenly, what used to take 60,000 square feet happens on one server rack, and now we’re overbuilt.

The other thing is that technology is moving so fast, I would imagine you would know more than me, but in 30 years, how fast technology moved, where after Microsoft has gone, now the layout where they were all air-cooled servers, they’re all liquid-cooled servers. I don’t know what more modification will be necessary for that landlord, but you’d have a pretty big bill to upgrade the technology at the end of each lease.

There are still facilities that are operating that were built twenty years ago in these co-location spaces. Some of those were long-term leases, but they do flip. There’s still a market that people who do not need these high densities that we’re talking about. It is a hot topic in our world in data center design, these enormous loads are driving all the change.

There’s still a strong market of people in the smaller avenue that can still accommodate the historical loading power densities that older facilities were designed for. As designers, forward-thinking, there’s a lot of unknown what is going to happen. You do want to design a facility that is purposely built for what it’s doing now, but in many cases, some philosophy or thought is given if it needs to change.

Can you give me an example of a design decision that fell into that latter category?

It’s very common. Will it need liquid cooling? When you’re designing a space and you’re building it on spec, will it need liquid cooling? Will it not need liquid cooling? You don’t know. You don’t know what those requirements are. You’re looking at the facility and looking at ways your base design will not incorporate liquid cooling, but your planning will allow that to come in some time down the road. Hopefully, it’s still in design, or if it’s being built, it’s easily flexible in order to pivot without having to adjust the bones of the building.

You need to have your structural loading in order to accommodate. You don’t want to go back in and reinforce everything. You want to have your clearances able to accommodate the additional equipment without relaying out the whole building and possibly losing some leasable space. Those are the things that we’re looking at now in the planning to make sure that there is flexibility for what we see possibly coming down the road now.

Is that as simple as a 24-inch between or underneath of the floor where the servers sit with flexible panels or something like that, that would allow someone to modify that at a future date?

Somewhat, the raised floor system, fewer facilities are using that. Twenty-four is a lower density height. We’re getting commonly at 30 or 36 inches or more in order to get the air up to that 10 kW that we were talking about before. The raised floor now is going away, and the room is being pressurized in order to do that. Air management is critical. There is a planning. When you’re planning the facility, it is important that you are planning hot and cold aisles, as I was talking about.

The servers have intake. That’s where the cold air comes out. It has exhaust. That’s where the hot air comes out. You never want those two to mix. There’s containment that surrounds the servers so that those two, the cold air being blown within the space and that hot air being pulled back to the units to be cooled again don’t cross.

Were they like that 15 or 20 years ago too?

When I started my career, you’d walk into a facility, and the servers were blowing hot air and it was a disaster. It’s funny to look back and think that’s what was going on. It’s now unheard of. You would never do that. Why? You’d walk in, and that management philosophy, certainly the first thing you would say, “Fix your airflow.” You have to fix your airflow in order to be more efficient in your power consumption.

I imagine that’s not cheap to do that though. Fifteen or twenty years ago, it wasn’t necessary. Why would you want to spend all the time with plexiglass walls and sealant and everything? It’s expensive to put that. Come on. We’re just trying to get this thing leased.

Who would have thought you would have been in this problem? Over the last 10 or 15 years, there’s more of a concentration on making sure that doesn’t happen in that containment.

The Cost Of Building A Data Center

That’s smart. Speaking of the costs to build, do you have any big numbers per square foot or anything like that, that you’ve seen go down? What’s the cost? If they’re spending $2,300 a foot to buy an existing data center. I think they were going to put another billion dollars into it or something like that. What is it, $2,100 a foot to build it? $1,600 a foot to build it? Does this include all the equipment as well?

There’s a lot there. The land and the building are enormous costs because it has all the equipment, but then the IT build-out of that is something I can’t even guess for you. The costs that I’m seeing on single cabinets and some of these servers are in the multi-million-dollar range. Millions and millions of dollars. I’m not even going to go to what the IT kit costs, to be honest with you. On developing the buildings, I don’t have a good recent metric. There was a time when we were looking, and we were quoting $10 million a megawatt. I think now, with the things that are changing and the demand in the sector, those numbers are increasing.

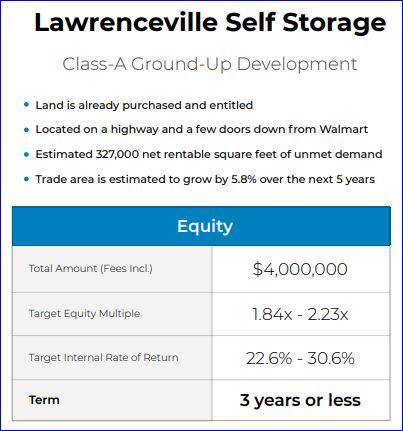

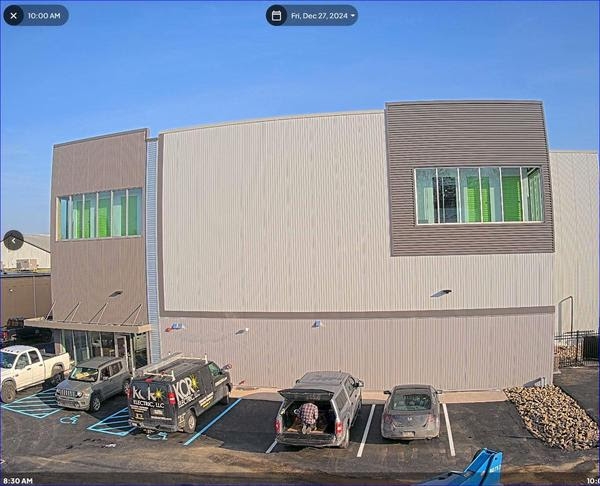

It’s probably going to be more than spending $106 a foot to build a three-story Class A self-storage facility in Lawrenceville, Georgia. I can’t just go throw a couple of racks in there and call it a data center.

You could, I’m not sure how much you’re going to lease it for. Your return and your investment might be a little different.

We’d have to go after that old twenty years old rack that’s still operating. Secondary market sounds like. $500 or $400 a foot, do you think, for the envelope, you had to guess?

I think it’s somewhere in there. Don’t quote me on that.

No one is going to call you from my audience and try to build one and be like, “Chad, you said this was $400. What do you mean by $750?” You’re like, “Inflation. What do you want me to do?”

That’s a moving target, but I would say something in that range on a square-foot basis.

Community Education And Sustainable Practices

What else did I forget to ask that you feel might be interesting or important for the audience here before we wrap up?

Something interesting in this space is data centers have gotten a lot of bad publicity. They use a lot of energy, they’re dirty, they’re loud. I think there’s a lot of concentration on what we’re doing now to try to educate the public on what is a data center. Do you know every time you go on social media, you’re connecting to a data center? I don’t think generally people understand how that affects their daily lives and what it means to us.

Communities are a little shy and, “I don’t want that development in my backyard.” I think as an industry, we’re looking at expanding our education to the world on how you use them. They’re not scary. If you look at buildings that were done twenty years ago, they’re gray boxes behind this big security fence. They’re somewhere you never go. You’re not allowed to go there. How do we change that image?

There’s a lot of push within jurisdictions and other areas that buildings are contextually designed to fit within the spaces. That is a little bit more community-friendly, and then certainly educating people on how and what and why they’re there is one thing, what are the benefits they bring to the community and our lives, and then also educating. It’s a market that’s growing so much that it’s hard to find people to come in and help design. One, help operate. There are not enough people operating them.

As an industry, we are pushing for better public education on what a data center is, why it matters, and how it benefits the community.

There are not enough people to construct them, and the skilled labor that is associated with that. I think seeing more push in the education front in order to promote communities, allowing more of these, understanding them, also promoting knowledge in what it takes to design, operate, or build these facilities in order to encourage people to come into the trades or the design aspects of the space.

It doesn’t sound any different than anything we ever get entitled to or improved. It doesn’t matter if it’s a single-family house, a shed or a hot tub in the backyard, a storage facility, or a giant flex warehouse. They never want it done. Everyone hates it. They don’t want the corners turned into a Wawa, which is the convenience store in the Northeastern United States where I grew up. They don’t want it there, but then they shop there and get their gas there. They’re there 5 out of 7 days a week. It’s like, “You guys were fighting this. What are you doing?” A data center does not necessarily have heavy truck traffic in and out all the time.

Your biggest demand is under construction. When you’re building it out, the actual amount of people in the spaces is minuscule compared to the size of the building and the traffic. There are a lot of benefits in some cases in a lot of communities because you don’t have to upgrade all of your support barriers, roadways, or all that because it’s not a big office space where you’re having a thousand people go to that facility.

A thousand trucks and a million-square-foot bomber of an industrial warehouse are never going to work. Before I ask my final question, is there anywhere our audience can go to get some more information about this, you, or maybe HED Design?

I’m happy to have anybody visit our website. The website is HED.design. You learn more about us and what we do there.

The Kindest Gesture Chad Has Ever Received

My final question. What is the kindest thing anyone has ever done for you?

That is an interesting question. I don’t think I’d be where I am without many people doing a lot of kind things for me. Certainly, how do you pick one of those out of all of them? That’s a difficult choice. When you look at it, family is the kindest thing. Certainly, all my family, my coworkers, and everybody does an immense thing. I have kids, I have to say. I have two sons. When one of them runs up and gives you a hug, that is the kindest thing that happens to me any time. That’s it.

I love it. I have pages and pages of notes here. I appreciate you coming on the show and giving us your time. What an interesting topic at the forefront of our technological revolution known as human existence here. Thank you, Chad, for coming on the show.

Thank you for having me, Dan. It was great to talk to you.

Important Links

Relevant Episodes

- How to Make $300K/Year Investing in Mobile Homes with No Money Down

- How to Make $100K or More Per Deal with Tucker Merrihew

- Unlocking Multifamily Millions: How Vlad Arakcheyev Transformed from Graphic Designer to Syndication Powerhouse

- Chris Prefontaine on $75,000 Average Profit Per Deal