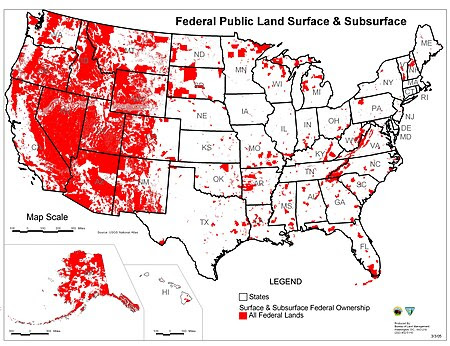

Trump proposed providing Federal Land for development of homes to address the housing shortage. Surely, this utopia will be named after Trump. I assume this will also provide streamlined zoning to allow record speed in constructing houses and the necessary infrastructure. But then the problem all real estate developers & investors face:

Who Will Buy these Houses? Why Move to Trump’s City?

To solve this issue, I propose a 5 year Federal Income Tax Amnesty on the 1st Million in income for residents who agree to establish residency in Trump’s City AND agree to remain a resident for 10 years. This would incentivize people to move and remain after the tax-free period expires. Here are the options for the location(s) of Trump’s city:

Since you read the subject line & are now reading this, I’m guessing you may have thought, “Wow, I can move INSIDE the US and find a tax haven?” If fact, a policy like this, on maybe 25,000 acres, might allow for 50,000 residents.

This would create a land grab along the lines of the opening of the frontier in 1889. There would need to be a lottery, and perhaps income bracket quotas which could be filled strategically so as not to create a federal housing project along the lines of Cabrini Green over time. Far better to have a wide range of incomes to give the city a solid foundation for future desirability & innovation.

Truth be told, much of this land is not really buildable, so I’m not sure how realistic this whole plan is. Anyway, I’m done dreaming about US tax policy. Having written several large checks for 2024 taxes, and watching bonus depreciation waning to just 40% this year, I am anxiously awaiting the expected tax code updates from our newly elected President…