Good Morning!

Here are today’s highlights:

- 25 Unit Apartment Portfolio for Sale

- How to Redevelop Dying Malls (Podcast Released)

- On the NAR Buyer Agent Settlement (I LOVE Paying Brokers!)

- Private Lender Webinar Details & Registration

First Time Reading? Sign Up Here

Private Lenders -vs- Hard Money Lenders

Last week I asked if anyone was interested in attending a zero cost Private Lending Webinar and the response was strong. The Hard Money industry has stolen the term “Private Lender” and used it in place of “Hard Money Lender” to dupe investors into calling them with excitement-thinking they’re calling a real Private Money Lender. Here’s the difference:

Private Money Lenders are private individuals with the cash in the bank to simply wire the money into closing. The terms set between a real Private Money Lender and you, the borrower/flipper/investor. Hard Money Lenders normally have set terms which are not flexible and cannot be influenced by you, the borrower.

Hard Money Lenders – They Set the Terms

- Monthly Payments

- Down Payments 10%-30%

- Underwriting of Tax Returns, Credit, Etc.

- Appraisal Contingencies

Private Lenders – You Set the Terms

- Balloon Payment Upon Sale – No Monthly Payments

- 100% Funding of Construction & Purchase

- No Underwriting Necessary

- No Appraisal Necessary

In a volume flipper’s business, there may be a place for both Private & Hard Money Lenders. I can get Hard Money for 1 point and 9% interest, yet I choose to pay 2 points & 10% interest to my Private Lenders. I do this because they’re easier for me to deal with and I enjoy sharing double digit returns with my Private Lenders.

Private Lending Webinar – Friday 7/12/2024 @ 1:00p ET / 12:00p CT

This Friday I am hosting a no-cost, high value Private Lending Webinar. I am doing this to help those on my buyers list become even better buyers than they are right now. When more people have access to Private Money, more people can buy our deals. Here’s what we’ll cover

- From the Borrower/Investor’s Perspective

- Presenting a Deal for Funding

- Where to Find Private Lenders

- Setting Favorable Terms

- Offering Additional Security for the Lender

- From the Private Lender’s Perspective

- Where to Find Borrowers

- Underwriting the Investor AND the Deal for Risk

- Setting Favorable Terms

- Obtaining Additional Security from the Investor

If you’d like to attend the Private Lending Webinar, please complete this registration form to be added to the list. Attendance will be limited to those that register. BTW-I’m selling nothing here, no pitch-just powering up my buyers so that they can buy & invest in more of my deals.

Are Buyer Brokers Commission Going to Disappear?

The NAR has been on everyone’s mind recently. Many speculate that buyer broker commissions are going away. You can read the details on the NAR website and realize that this is not the case. Agents & brokers will simply need to arrange a new structure for how to get compensated. The main item I notice is the removal of the Buyer Commission field from the MLS.

Well here’s the good news: If you’re representing a buyer from a deal I send you, we normally offer 2.5% and have no intention of changing that. If I am paying a commission, that means I have received an acceptable offer. Very often, the strongest offers I receive are made through a skilled buyer’s broker-who surely helped that buyer figure out how to offer the right amount to win them the deal.

Buyer brokers provide priceless value in guiding clients to make correct offers and navigating them to the closing table. Some investors and buyers can do this on their own, but in my experience 99% of buyers in the US real estate market need a bit of a push to trudge through transactions and actually close. I appreciate the real estate brokerage community and will gratefully show my support by continuing to make commission payouts at closing!!

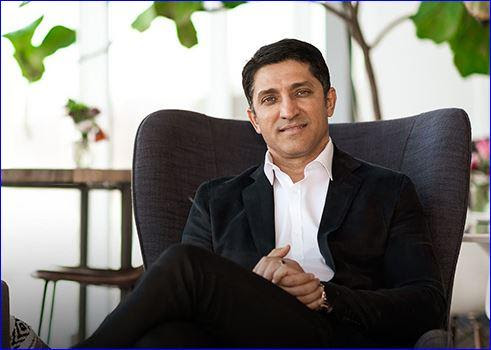

Podcast Just Released – Redeveloping Dying Shopping Malls Part 1

Rafik Moore, of Brait Capital & I discussed the process of buying & redeveloping Dying Malls around the US. What does it take to stabilize a 511,000 sq. ft. commercial real estate deal? How much does it cost to buy a deal this size? Rafik & I cover this, and more in this week’s REI Diamonds Show episode. Keep an eye out for his partner, Saul Zenkevicius’ REI Diamond Show episode being released next week. You’ll hear the other side of this dynamic dou’s story.

Rafik & I met at the Commercial Academy event held back in 2022. Since that time my idea of “a good deal” has changed dramatically. Six figures became seven. Rafik & I will both attend the upcoming Cleveland event – August 23-25th. If you’d like to be my guest, please email me using the subject line “Commercial Academy”. The cost to attend is $897.

25 Unit Chicago Portfolio For Sale

Interested in Either of these Apartment Buildings Below?

Call or Text Jason Marcordes at 630-842-5557

10 Unit Apartment Building

6221 W Wabansia Ave, Chicago, IL 60639 – Price $1,149,000

- 10 Legal Units, Each 2 Bed 1 Bath

- Current Gross Income $150,000+

- Galewood Neighborhood

- $500,000 Capex in Past 4 Years

- Separate Electric & Gas/Heat Meters

- 9 New HVAC Units

- Room to Raise Rents

- View Offering Memorandum

15 Unit Apartment Building

9211 S Laflin St, Chicago, IL 60620 – Price $1,299,000

- 15 Units (1 is non-conforming)

- Current Gross Income $190,000+

- Brainerd Neighborhood – Near Beverly

- Separate Electric & Gas/Heat Meters

- Includes the Parking Lot

- Room to Raise Rents

- View Offering Memorandum

Price $1,149,000

Prefer Single Family Flips & Other Below Market Deals?

View 19 RE Investor Deals for Sale in Atlanta, Philadelphia, & Chicago MSA’s