Happy Sunday!!

As we are all now settling down for the Holidays during these final weeks of 2024, many of us are planning our goals for 2025. One of the guys on our team here currently has $1.3 Million in profit working it’s way through renovation, sale, & closing across 12 deals. Most of this will close in 2025-but I assure you he’s aiming much higher than that for 2025.

I share this not to brag, but hopefully to inspire! I hope the other 22 people who share his role & title (Acquisition Manager) read this and contemplate what’s possible for themselves in 2025. Or perhaps you read this and also are inspired as you plan your 2025. Or, even better for you, you see that number and remember setting & achieving goals like this in years past-and will blow way past that again in 2025, without question.

The fundamentals in commercial & residential real estate support our strong 2025: lower interest rates, still record-high pricing, and mostly tight inventory that’s expected to let up some this year. This will break the logjam and allow us real estate investors & professionals to get back to our strong volume again.

Here at Diamond Equity, we have the reasonable expectation to double our business in 2025 due to improvements in every facet of our business. The major issue we will have is being understaffed-especially in Acquisition Managers.

To handle the increase in volume, we are looking for Acquisition Managers in each of our offices: Atlanta, GA (Roswell office), Phila, PA (Folsom office), & Chicago, IL (Chicago/Schaumburg office-we’ve moving soon). If you want to join us for 2025, reply with your resume & why you believe you’re a great deal maker.

Also, if you’re already crushing your business, and have no interest in joining the team, I’ll ask a favor: If you know someone with a strong ability to sell & close deals, would you mind making an email introduction to me personally? My email is [email protected]

*Real Estate experience is not necessarily a plus here. Our current team members who joined with construction/roofing sales, car sales, or other high ticket sales experience actually perform much faster than people with only real estate experience. Our most profitable deal was closed by a former car salesman in the high 6 figures.

Here’s today’s agenda:

- For Sale – 44 Real Estate Investor Deals

- Rehabbed Warehouse-Flex Space For Sale $425,000 ($56K NOI)

- How to Tell if Someone is a Successful Deal Maker

First Time Reading? Sign Up Here

Doing a Deal with Diamond Equity

Here’s What I’m Buying:

- Retail Strip or Shopping Center 10,000-250,000 Sq. Ft.

- Industrial or Flex Warehouse 20,000 – 250,000 Sq. Ft.

- Must be value-add, either low rents OR vacancy, or both

For Sale 3147 Louis Sherman Dr,, Steger, Illinois

- 3,950 Sq. Ft Warehouse + Office

- 6,500 Sq. Ft. Fenced, Paved Yard

- Taxes Approx $9,420/Year (2024)

- Insurance approx $2,600/Year

- Recently Rehabbed

- Tenant Ready to Sign at $5,750/month MG

- Projected $69,000 Gross, $56,980 NOI

- M1 Zoning (map) See pg. 57 for uses allowed

- Buy it Now Price $425,000 (Value with signed lease: $670K @ 8.5% cap)

This warehouse has been completely updated and ready to move in. Perfect for contractors, storage, certain auto repair, warehousing etc. This place would be ideal to store a car collection, boats, jet skis, etc.

This week you have the chance to buy a nearly-turn key warehouse deal. We are very close to accepting a lease for $5,750/month, or $56,980 NOI. Once this lease is signed, the value at an 8.5% cap rate will be $670,000.

Buy this all cash, sign the lease, and refinance $469,000 cash back out at 70% LTV. At 7.25% int. and a 25 year amortization schedule, you’ll have all of your cash back (inc closing costs & a check for $20K or so) and about $500/month cash flow. Not bad for NO money in the deal and NO rehab necessary. Your deal gets even better if rates drop or the market provides a lower cap rate.

One thing here: once we sign the lease, the price goes up to $500,000. You can buy now for $425,000 because you’re accepting the vacant property risk and you earn the reward ($670K value). Once this lease is signed, that vacancy risk is removed, and so is some of that reward!

I’ll be in Orlando at this Commercial Academy Event

You Can Register Here

Successful People Like My…

Successful people like my text messages. Let me explain. I send a successful Deal Maker a text and they almost immediately “like” the text. Or send me a reply quickly. Successful Deal Makers “like” the text to acknowledge what I’ve sent-it’s like a read confirmation, but with more attention provided. I KNOW they’ve seen what I sent.

On the other side, people who procrastinate, don’t pay attention to their phone, don’t do anything. Maybe I get a reply, maybe not. No “like”, no acknowledgement. Probably no action on their part.

Successful People are ALWAYS Testing You

That reply, that “like” of my text is a actually a small test! SUCCESSFUL PEOPLE ARE TESTING YOU based on their speed of reply. I’ve hired contractors, brokers, loan officers, inspection companies, & even Acquisition Managers based, in part, on their responsiveness.

Believe it or not, some people are simply not responsive. Perhaps they simply turn off their phone at 5:00-or all weekend-because they have more important priorities than being responsive. It’s ok if they have other priorities and care more about their quiet time my business, but if I’m going to layout sums of MY cash in your direction, I honestly want you to care highly about MY business.

I see it like this: if I’m hiring a broker to sell one of my commercial properties, and they don’t reply to my text, will they reply to the inbound text from our buyer?

If I hire a mortgage broker to procure a loan, and they don’t reply to my text in a timely manner, will they delay underwriting with that same procrastination? Will the delay put my (sometimes 5 or 6 figure) EMD in jeopardy later when requesting an extension because their delay caused a delay in funding? Will they cost me that deal & the EMD if that seller doesn’t agree to extend?

We are in the real estate business. There are large sums of money at risk at all levels of this business and at every stage of every deal. There times when a call on a Sunday afternoon, or 7:30p on a Friday wins you the deal. Or a text during those same times keeps your deal alive. Even Steve Schwarzman talked about several deals made on a Sunday in his book, “What it Takes.”

I am not saying you must be on-call all the time, life happens and there are legitimate reasons for a slower reply. The trouble begins when the slower reply become the habit, and then eventually no reply happens. This “no-reply” is absolutely unacceptable. Better to reply quickly than be labeled as a “no-reply” kind of person.

Perhaps there are successful people out there who turn their phone off at 5 and don’t care to be bothered at certain times. Perhaps they’ve earned that right by earning an 8 or 9 figure portfolio and don’t need to be responsive anymore. Real Estate is tricky because for many, this is the end goal: Get Rich & take it easy.

Well, this isn’t me, and it is not how the team at Diamond Equity has already closed 245 deals this year. I personally enjoy the game-the business of transforming the Earth, one deal at a time, one parcel at a time. This is my lifestyle, my hobby, even my purpose.

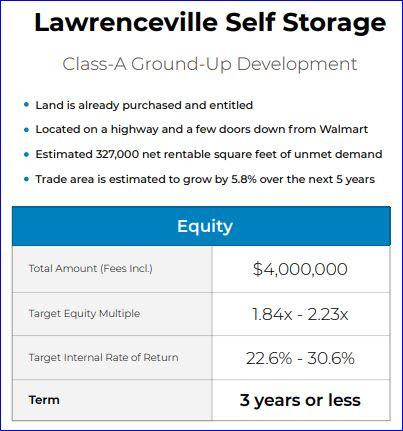

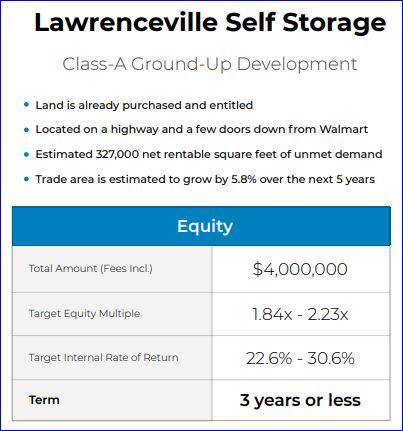

We have a small allocation remaining here. The minimum investment would be $50K and open to accredited investors only.