Happy Holidays fellow Real Estate Investor!

With the New Year just days away, everyone I know is already thinking about next year. I’ve found that asking the right questions as I plan helps produce the most desired result. Here are a few I ask as I evaluate my own goals & plans:

- What is the #1 skill I have now which produces the most results? Can I expand this further? 80/20 rule, 80% of results come from 20% of our actions. IDENTIFY the 20% most impactful actions

- What are some things I do, which cost time, that produce little, or even no results? Can I say “No” to these things next year to growth my results in other areas? 80/20 rule again. This time, I’m cutting out some of the 80% of actions which only produce 20% of the results

- What will life be like a year from now if I recreate certain areas of my life around my current/future goals? This is a visualization, with eyes closed, SEEING myself living life one year in the future

- For any goal on my list, am I willing to pay the price to achieve it? Every goal has a set of actions, beliefs, and time/money investment required to achieve. It is important to understand the cost up front, when setting the goal and deciding whether or not you actually want to do/believe/pay to live out that goal

My goal for 2025 is to double the gross profit of our company. That means either every Ac Mgr on the team will also double their income (already avg $150K/year+ each) OR we have to hire a few great Deal Maker’s to help carry the load. I’m sure we will have a combination of those 2 scenarios in reality.

The cost to achieve this goal is more & better leads for the team to work. Using the 80/20 framework, we are focusing our lead gen machine at the 20% of lead sources which have created 80% of our results. We’ve our own AI model to do this and, because of our 250 deals per year and industry leading data structure, we have an industry leading data set with which to train the AI model. These are the Glengarry leads!!

Want to work these with us in 2025? For details on joining Diamond Equity please go to careers.diamondequity.com

Here’s today’s agenda:

- For Sale – 36 Real Estate Investor Deals

- Self Storage Investment – 22%-30% IRR Target

- Meet me in Orlando on Jan 31?

First Time Reading? Sign Up Here

Doing a Deal with Diamond Equity

Here’s What I’m Buying:

- Retail Strip or Shopping Center 10,000-250,000 Sq. Ft.

- Industrial or Flex Warehouse 20,000 – 250,000 Sq. Ft.

- Must be value-add, either low rents OR vacancy, or both

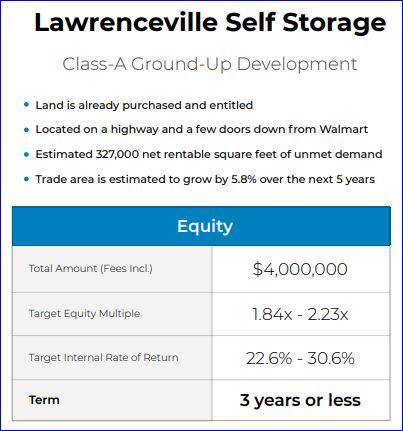

Storage Development Deal – Open Allocation closing Jan 2025

Want to Co-Invest with Me?

This is a picture taken yesterday outside of the Wilkes Barre, PA storage development project. We are building a similar project in Lawrenceville, GA and breaking ground in Jan 2025. We have about 1/3 of the $4M allocation available for investment. You can watch the Investor Presentation with Fernando Angelucci & I here. (reply to this email for the access code)

Due to Diamond Equity’s office operating in the Atlanta Region for the past 8 years, we have had a front row seat on the explosive, yet sustainable growth present in the Lawrenceville, GA market. We also have experience in large scale residential sub-division development in the region.

The terrain of Georgia creates a perfect storm for long term Self Storage demand. Due to the rocky, hilly terrain found in the Atlanta region, many houses must be built on slab-which means there is a large portion of new home inventory which does NOT offer a basement. No storage in the home creates the need for professionally managed storage space.

This facility will be built on Lawrenceville Highway, with full frontage. From the data sourced from my other facilities, we know that more than 50% of storage tenants come from road signage. Lawrenceville, GA is tough to get development approvals, which we have. This creates a barrier to future competition-and another reason we moved forward on this project.

Interested in Investing? Or have futher questions? Schedule a Call

I’ll be in Orlando Jan 31-Feb 2 at this Diamond Inner Circle – Commercial Academy Event. Want to meet me there?

Here’s Why I Attend:

- Network: There will be more than 100 Commercial Real Estate investors attending-most seeking JV Partners who can bring them deals.

- Knowledge: There will be 9 presentations of recent & active projects. There is no other place to get this level of “behind the scenes” details-most CRE investors are highly secretive and NEVER share any of their strategy.

- Deal Flow: I own a shopping center, several storage facilities, 2 mobile home parks, and some flex industrial – all deals which discovered at these events.

- Orlando, FL: I love the warm weather this time of year in Florida!!