Since Jan 1, 2023, we have bought & sold more than $96M in residential real estate. Not a single deal was more than 6 units. And we made a profit on more than 97%. Do enough deals, you’ll take a few losses. The key to success in real estate? Do MANY deals, not just one. Many eggs in the basket. Some will break.

Here’s today’s agenda:

- For Sale – 33 Real Estate Investor Deals

- Rockefeller’s Strategy applied to Investing

- Podcast on How to Flip Commercial Deals for $1M+ Profits

First Time Reading? Sign Up Here

Doing a Deal with Diamond Equity

Quick Shout out to Robert Jones for sending over a few deals to review. These didn’t exactly fit the buy box, but I am grateful for the chance to view.

Today’s Featured Deal For Sale 6.71 Acres, just $95,000

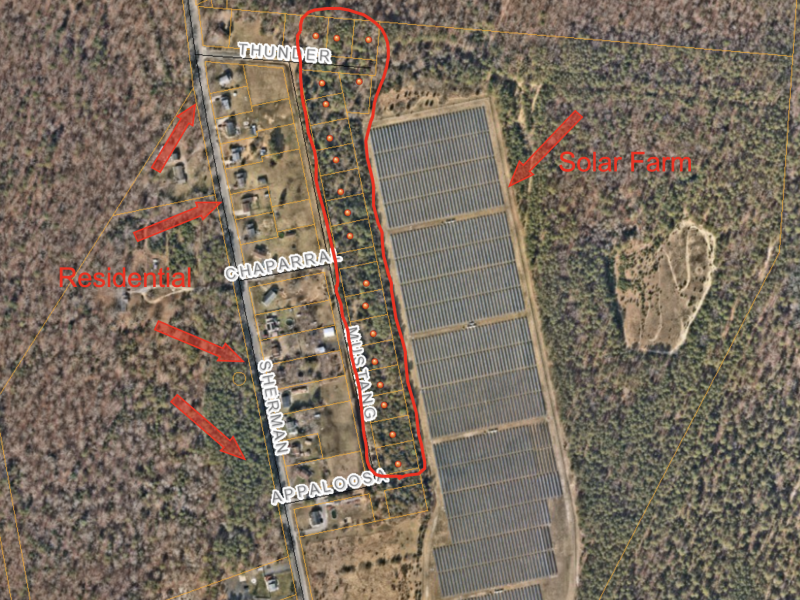

For Sale 19 Lots on Mustang Dr. Vineland, NJ 08361

Here is a chance to buy & develop, or simply land bank 6.71 acres. Just across the street there are approximately 17 houses. On the back side is a solar farm-which will make for quiet neighbors.

This project has not been soil tested or entitled for construction, which is why the price is so cheap. If it were approved, the value would likely be 2-3X your purchase price of $95,000. If you buy it and get it approved, you drive the value.

Or, just buy it and sit on for a decade or two. Taxes are cheap enough.

- 19 lots across 6.71 Acres

- W5 Zoning Allows Single Family

- No soil test, or survey available

- Photos here

- For details, contact Amanda at 215-987-6705

- Price $95,000

Here’s What I’m Buying:

- Retail Strip or Shopping Center 10,000-250,000 Sq. Ft.

- Industrial or Flex Warehouse 20,000 – 250,000 Sq. Ft.

An ideal property might be a shopping center you notice with many vacant spaces. If you notice a property like this, please refer that location to me by replying to this email. I’ll hunt down the owner and never stop until they sell to me. If I close the deal, I’m happy to include you in the General Partnership ownership stack with an equity stake.

Kiavi offers Hard Money Loans Starting at 9.64%

Volume Flippers may Obtain $1M+ Lines of Credit

Get $350 Credit on Your First Loan – Begin Here

Sign up Now, even if you’re not ready to borrow & lock in your $350 credit

How to Flip Commercial Property & Profit $1M+

My buddy Sean Katona & I recently recorded an REI Diamonds Show episode on how he has flipped several commercial properties in the past few years netting himself & his investors profits exceeding $1M on each. Listen here

John Rockefeller’s Strategy on Obscene Returns

While Diamond Equity does NOT enjoy the kind of monopoly that John Rockefeller built with Standard Oil (that’s Exxon/Mobil today), we have used his business strategies to build a company that has bought & sold $96,000,000 in real estate since Jan 1, 2023. Since we were founded in 2006, that number is likely 4-5 times that figure.

We’ve been blessed & lucky in the market for sure, but even more importantly-just like Rockefeller-blessed & lucky to have assembled a smart, loyal, & hungry team to create this reality. I suggest listening to The Founder’s Podcast Ep 368 – a review of Rockefeller’s autobiography.

One nuance of the Rockefeller strategy was in buying assets that compounded inside the business. Let me explain. If you earn $182,101 or more per year flipping houses, you’re paying 32% in federal tax alone. So on that next $50K in income, you end up with $34,000. This is a good problem to have-because you’re making good money.

As high-income real estate investors, we have 2 options to compound our money inside of the business the way that Rockefeller did:

- Long Term Rentals – Long term rentals are likely the best place to start if you’re in the front end of your real estate career. Once you reach a certain amount, maybe 10, maybe 100 depending on what you buy, you realize your rentals are a BUSINESS. A hungry business that requires a team and your attention to continue the compounding effectively.

- Passive Investments in Syndications – Investing in syndication deals is where you place your money with the operator and allow THEM to be the BUSINESS that compounds your money. I look for syndications which will double my money every 5 years.

Doubling your money every requires a return of 14.4% per year with NO tax paid along the way. This is the tax-efficient mindset toward investing that syndications provide. Double your money in 5 years, if compounded at 14.4%.

If you managed to flip houses and earn 20% return each year, pay tax at 32% (or more), and compound that amount every year for 5 years, you’d end up just short of doubling your money. The math can get complicated, and I won’t waste your time going through it here right now.

The point I’m making here, and the lightbulb moment for me, is that the most efficient investments I can make are into other businesses with great teams, solid business models, and competitive edge in their space which the value will compound over time without getting shaved by taxes until the very end-after it has grown in value. And, at this later date, treated as long term capital gains instead of ordinary income.

Who are Great Operators? Meet Henry Flagler & John Rockefeller

The photo above is an actual Standard Oil Stock certificate I keep in my office, always within sight. I find it inspirational that John Rockefeller & Henry Flagler both signed this certificate. They’re energy is here, with me, as I negotiate deals, conduct my business, and write this email.

Henry Flagler was John Rockefeller’s business partner. He was a few years older and together they built and operated Standard Oil. Once retired, Henry Flagler fell in love with the warm weather in Florida and became the real estate developer responsible for much of East Coast Florida. He even built the Florida East Coast Railroad through the keys, which eventually became The Overseas Highway extending US Rt 1 to Key West. These were HUGE risky projects-but their impact on our country, tremendous!

Henry & John provide an excellent standard for what to expect in Great Operators. They knew the details of their business. They always strive to evolve the business, regardless of how much success they achieved. These are the kind of people I want to be in business with. Either as my business partners, or those with whom I can place my capital.

Seek quality. Or, if you haven’t yet gotten rich enough, BE quality. Become great. Be a great partner, find great deals. The gates of Heaven will open and pour upon you more opportunity than you can handle. Reading the biographies, or even listening to the Founders Podcast are a great path for anyone seeking to succeed at a higher level in the business of making money.

Oh-and if you’re in Palm Beach, be sure to visit the Flagler Museum. I stumbled upon it by accident a few years ago-and discovered a rich history and source of extravagant inspiration right on the water in one of the toniest real estate markets in the U.S.