Flipping Houses IS the Best Business Model in 2025

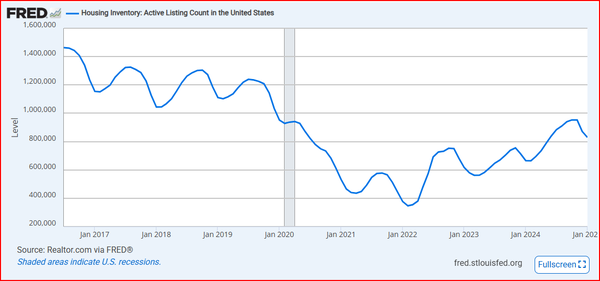

Existing-home sales have decreased by 4.9% in January, marking a notable shift in the market. Current mortgage rates still remain above 7%. On top of that, inventory levels have risen by 16.8% to approximately 829,376 active listings. Sounds bad, but it is not even close to what has been normal for my entire career spanning more than 18 years. See the Fed Chart below for historical inventory levels.

Flipping Houses has NEVER been Better

Flipping houses from 2006-March 2020 was a real challenge. I remember wondering if anyone would buy each renovated house I was building. It felt like a miracle when we got the offer-and yet another if it appraised & closed. Since 2020, even the past 12 months, the majority of houses we’ve renovated have sold for higher prices than we thought when we bought the deal. And the sales have mostly been in 14 days or less. What a great time to be alive & flipping houses!

- Houses are Liquid. They sell or rent extremely fast-usually 60 days or less for a sale, 30 days or less to rent. Assuming you’re priced appropriately. Contrast this with my commercial properties. Shopping center units & industrial buildings often take 12-24 months or more to rent. My recent apartment building sales took 12-14 months from the For Sale sign to the closing. I love 1-4 unit residential properties for their lightning fast sale cycle.

- Renovated Houses are a Premium Product. A well designed & tightly executed renovated house is a special product to the home buyer seeking their dream home. Whether a starter home or their forever home, when it’s renovated, it commands the highest value. They aren’t comparison shopping-their fulfilling their dream. It’s like a Lexus buyer-they buy for the experience of ownership, NOT necessarily to get a good/great deal.

- Inventory is Extremely Low. The wind is still at our back-there are still VERY LIMITED options for home buyers. Even less so the buyer seeking a Renovated Home.

- Now is the Time to “Time” the Market. Home prices will peak between March 15-June 15, 2025. In many markets, these numbers will be the absolute highest prices ever paid for Renovated Homes sold in their respective markets. That said, there are a small number of micro-markets which peaked in 2022 and have cooled since then.

How to Play the Market

If you don’t already have fix & flip deals in process, right now is the time to find one, or several, assuming you have capital and contractor resources to execute quickly. Your goal is to hit the market by June 1 to hit the peak selling/peak pricing season.

Submit quick closing offers with large earnest money deposits. Most “standard” transactions close in 30-45 days. When I want to win a deal and I have contractors ready to go, I’ll close my deals in 7-14 days. Why wait??

My earnest money deposits are almost always 10% on deals under $250K. Once I make an offer, I’m planning to close no matter what, so the large EMD is not a risk to me. The certainty of closing & my quick timeline is the reason my offers win so often.

Of course if a seller needed more time for some reason, I might wait around. Better to book the deal into my schedule and find another for the near term More deals=more opportunity to get lucky in the Spring Market. Although it doesn’t happen as often as 2022, we experience the “multiple offer situation” most often every year between March 1-June 30. It’s been that way since 2006.