“What is Your Most Valuable Skill?”

I asked a successful real estate developer this question over a lunch early in my career. He sat back & thought a moment before answering with one word: “Vision.”

What is a Developer’s Vision?

I’d define a Developer’s Vision is seeing something that can be done with a property that no one else believes is possible within the confines of maintaining a profit. Often, there is additional investment to create a superior project to anything found in comparable sales-with the faith that your project will command a premium.

Developer’s Vision in House Flipping

House flippers with Developer’s Vision often buy houses from us in rough condition and are much more creative in their construction phase than I would imagine myself. Small one story house receives a 2nd story addition. The façade is transformed by adding a larger porch or reconfigured entry way. Both require additional investment compared to a standard renovation project where no major alterations are made.

Note that Developer’s Vision is different than simply fixing up a house and selling it. If you look at comparable sales and match the renovation to what the market has already accepted, this is not really a visionary activity. It may be the safest route to a profit, but no new, grand “Vision” was executed.

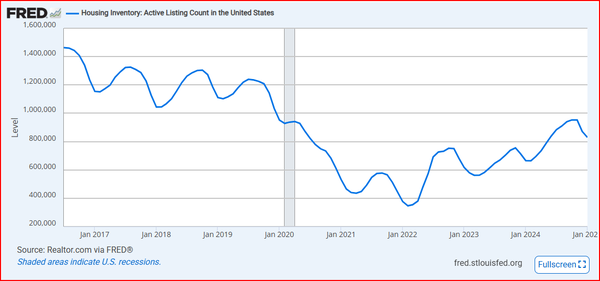

Executing a Developer’s Vision is risky because there are no comps proving the value. You build a 2nd story addition and create a 4,200 sq. ft. house in a highly rated school district where no other sold homes exist with more than the 2,100 sq. ft. home you modified within a half mile radius to “prove” the market’s willingness to accept such a home. Risky.

However, this same inability to “prove” value offers the opportunity to price much higher than you could if there were already another property just like it. This is where Developer’s Vision pays off big-assuming you’re right and the market agreed. This is how new price records can be achieved.

Here’s an example where a small additional investment, adding a small porch and “address shutter” feature transformed the curb appeal:

The interior of this home was also impeccably designed, and I’d say with optimal Developer’s Vision. (Developer credit RESolutions Team, LLC) Photos

Managing the Risk -vs- Reward

In conclusion, for anyone reading who has limited experience in flipping houses, I’d suggest ALWAYS matching the renovation quality found in nearby comparable sales. You might implement Developer’s Vision at a small scale, as in the front porch example above to test your design skill. Before executing a larger Developer’s Vision, such as a large addition or any project exceeding $10,000, I’d plan to have at least 20 successful projects under my belt.