U.S. flags at half mast because former President Jimmy Carter passed.

37,000 acres & 12,000 structures burned, & 11 dead so far. Still, these fires in California rage on. I’m praying for rain. And for everyone affected to get through this.

I got to Florida for the Winter this week and saw the destruction wreaked by the two hurricanes that swept through a few months ago. There is a lot of work to be done. Compared to last year, this place is a bit of a ghost town. Nearly empty restaurants-for those that are open-and a lot less traffic than usual.

Let’s just take a moment of silence this week for those facing these challenges (or any other catastrophic challenge not listed here).

Commercial properties are going to be worth less because of these disasters. Insurance costs are sure to rise yet again, eating further into the NOI of any property NOT on triple net leases, leaving lower valuations in the wake.

Here’s today’s agenda:

- For Sale – 34 Real Estate Investor Deals

- For Sale – 4 Warehouse Deals (One, in IL, is Off Market)

- Self Storage Investment – 22%-30% IRR Target

- Meet me in Orlando on Jan 31?

First Time Reading? Sign Up Here

Doing a Deal with Diamond Equity

Here’s What I’m Buying:

- Retail Strip or Shopping Center 10,000-250,000 Sq. Ft.

- Industrial or Flex Warehouse 20,000 – 250,000 Sq. Ft.

- Industrial 8,500 Sq. Ft+ on 3+ Acres

- Prefer value-add: either low rents OR vacancy, or both

- Prefer that you either Own, or are Direct to the Owner

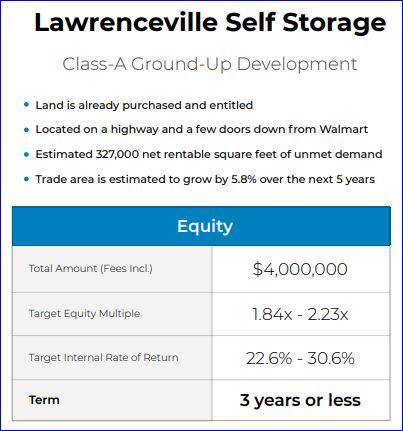

Storage Development Deal – Open Allocation closing Jan 2025

Want to Co-Invest with Me?

This is a picture taken outside of the Wilkes Barre, PA storage development project. We are building a similar project in Lawrenceville, GA and breaking ground in Jan 2025. We have about 1/3 of the $4M allocation available for investment. You can watch the Investor Presentation with Fernando Angelucci & I here. (reply to this email for the access code)

NOTE-I have an apartment building currently under contract and awaiting closing. Once that closes, the cash from that deal goes straight into this deal, and the allocation will be closed.

Interested in Investing? Or have further questions? Schedule a Call

I’ll be in Orlando Jan 31-Feb 2 at this Diamond Inner Circle – Commercial Academy Event. Want to meet me there?

Here’s Why I Attend:

- Network: There are more than 100 Commercial Real Estate investors attending-most seek JV Partners who can bring them deals.

- Knowledge: There will be 9 presentations of recent & active projects. There is no other place to get this level of “behind the scenes” details-most CRE investors are highly secretive and NEVER share any of their strategy. I may be one of the 9, I’ll keep you posted.

- Deal Flow: I own a shopping center, several storage facilities, 2 mobile home parks, and some flex industrial – all deals which discovered at these events.

- Orlando, FL: I love the warm weather this time of year in Florida!!