Here’s today’s agenda:

- For Sale – 31 Real Estate Investor Deals

- How to Turn $100K into $3.2M

- Georgia Self Storage Development

- Podcast on Building a Portfolio of Mortgage Notes

First Time Reading? Sign Up Here

How to Turn $100K into $3.2M

First, let me begin by stating that I am not an attorney and not an accountant-this is NOT legal or investing advice. This is my own experience and the way I view my own retirement and investment philosophy. My goal is to turn every $100K investment into $3.2M by the end of my investing career. I’ll call this 25 years.

Syndication deals are partnerships where money can be placed by Limited Partners and the day to day activity of that partnership is run by General Partners. At this stage of my career, I prefer these investments over the actual ownership of rental property because I can keep my focus on my main business, Diamond Equity, which is where I derive my income & investment capital.

I Need to Win 5 Times to Reach My Goal

I choose deals where I am expecting to double my money in 5 years or less. Here’s how the math works if I can win 5 times in 5 syndications over 25 years:

The Math, if the Investment is Made in a Self Directed IRA;

- Deal 1, invest $100,000 and receive $200,000 in return

- Deal 2, invest $200,000 and receive $400,000 in return

- Deal 3, invest $400,000 and receive $800,000 in return

- Deal 4, invest $800,000 and receive $1,600,000 in return

- Deal 5, invest $1,600,000 and receive $3,200,000 in return

The Math, if my Investment is made after paying 20% long term capital gains on each profit, assuming no tax code change, over my 5 deal, 25 year time horizon:

- Deal 1, invest $100,000 and receive $200,000 in return

- Deal 2, invest $180,000 and receive $324,000 in return

- Deal 3, invest $324,000 and receive $583,200 in return

- Deal 4, invest $583,200 and receive $1,049,760 in return

- Deal 5, invest $1,889,568 and receive $1,889,568 in return

Most of my personal syndication investments are done in the latter example, where I am paying tax at each profit event. Not optimal, but I didn’t come into the real estate business from another career – owning an IRA from a previous employer. If you want to learn more about self directed IRA’s, check out this podcast I recorded with Damion Lupo.

Yes, this plan assumes optimal performance across 5 deals. Challenging, maybe, but not impossible. I keep about 1/3 of my portfolio in real estate owned, 1/3 in syndication deals like this, and 1/3 in cash which I lend in short term Private Mortgage Investment Opportunities.

Below you’ll find details for my most recent syndication deal where I am investing my cash & also acting as a general partner. This means I am actively managing this project with Fernando and the construction team. If you’re interested in investing in this deal alongside me & Fernando, please reply to this email and I’ll send over the replay of the Investor Presentation we did a week or so back.

Wreaths of LUV – Order Yours today & Support Chicago’s Youth

These Holiday “Wreaths of LUV” are hand-crafted by the paid interns at the LUV Institute. Every year I order a few dozen and have them shipped to my friends & family all over the U.S. Order yours here.

Kiavi offers Hard Money Loans Starting at 9.64%

Volume Flippers may Obtain $1M+ Lines of Credit

Get $350 Credit on Your First Loan – Begin Here

Sign up Now, even if you’re not ready to borrow & lock in your $350 credit

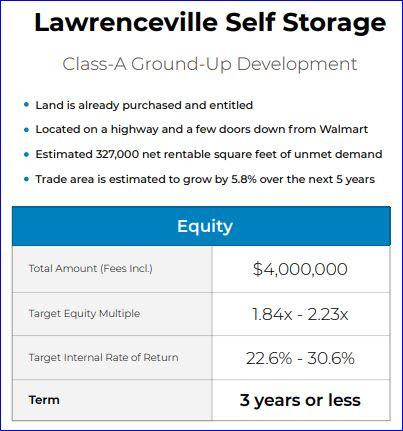

Accredited Investors – Just over $1M Remaining for this Raise

Lawrenceville, GA – 87,068 Sq. Ft. 3 Story Storage Facility

Reply to this if You’re Interested in Investing

I am building this facility with my partner Fernando Angelucci and his team at SSSE. Fernando has a background in engineering and has closed 53 Self Storage deals across 24 states with more than $230M in value. This project will be his 3rd Class A facility being built ground up. You can view his 2nd Class A facility-nearly completed here (located in Wilkes Barre, PA)

This current project is projected to run for 3 years, to allow 9-12 months for construction followed by 24 months to stabilize (rent), then sell the project. The buyer for the completed project will likely be one of the publicly traded Storage REITs.

Sometimes these REITs buy projects at CO (certificate of occupancy) and complete stabilization on their own. If this were to occur at a favorable price, this project may return capital much earlier than the projected 3 years. This would be good, but may or may not occur.

We already have the full $4M capital committed for this deal, but are opening up just under half of the deal from our own portion to accredited investors in our network.

I’m personally doing this deal for this reason:

- This deal is heavily in favors the investor/limited partners and offers superior potential returns than my 4.51% money market accounts.

- 80% of the profits go to the Limited Partners (The $4M capital raise)

- 20% of the profits go to the General Partners (who build the deal, guarantee the loan, and co-invest)

As a general partner, sharing a very small portion of that 20% with our team, this deal would not be worth my time. We construct deals like this as a place to multiply our own capital by investing our cash on the LP side of the deal. That’s why 80% of the profit goes to those partners-because it is the same people running the deal on both sides. These are the type of syndications I look for-where the general partners are running the deal to keep their money working-not simply to generate management fees for themselves.