Good Morning!

Here are today’s highlights:

- 30,000 Warehouse on 8+ Acres for Sale

- The Best Short Term Rental Market in the U.S.

- Any interest in attending a zero cost Private Lending Webinar?

Here’s How I Did My 1st No Money Down Deal with a Private Lender

It was September 2006 the market felt a lot like it does right now in 2024. We had peak pricing just in the rear-view and the prices were holding mostly steady. By this time, I had closed 3 wholesale deals, strictly assignments, and made a few bucks doing real estate deals. Still, I hadn’t fulfilled my dream – to begin fixing & flipping houses.

I met Craig in May by cold-calling his “house for rent” classified Newspaper Ad and trying to buy his house. We met in person at the local real estate networking group and kept in touch at those events. I found a deal I believed I could buy, clean out, and resell to a retail “handyman” buyer for a quick profit, but I didn’t have the $120,000 necessary to close. While a straight private loan would have been the most profitable route for me, I chose something better-and less profitable in the short term.

I assumed Craig had the money to close, and I was hoping to build a close working relationship with him. For this reason, I brought the deal to Craig with my plan: he brought the money, closed in his LLC (giving him control & safety in the deal-considering I was a relatively broke 26 year old…), I ran the cleanout and we split the profit 50/50. It was a smooth deal and we whacked up $38,000 on that deal. It was a good start.

Then on deals #2 & 3, I proposed he simply lend me the money to fix & flip them on my own. He reviewed the deals and agreed. I am still humbled that he took that chance on me back then. Both of those deals ran about 8 months and returned his points, interest, and principle – all in a single balloon payment – as well as netting me solid profits. This was only the beginning of the longer-term profits in that relationship with Craig.

Since 2006, Craig & I have partnered on over 500 profitable deals together and he is a key partner in Diamond Equity Investments. He’s also become a close friend and great mentor over the years. I am grateful that Craig is in my life and he took those chances on me back in 2006.

If you are looking for your first Private Lender, you might consider instead seeking a partner who can solve that issue for you. Every real estate deal has 3 components: Money to Close, The Deal, & Operations (renovation/management). Finding the Deal has been my superpower and aligning with partners for the money & operations has led to scale.

Private Lending Webinar

In the next few weeks I am considering hosting a Private Lending Webinar where I’ll cover the Private Lending from both the Lender’s Perspective & the Rehabber’s Perspective. If you’d like to attend the Private Lending Webinar, at no cost, please reply to this email and let me know you’d like to attend.

When it Comes to Short Term Rentals, Location is Everything

Well, that’s no secret, right? Location, location, location is THE real estate dictum in use for all of history. I’ve never been bullish on Short Term Rentals, at least in the Airbnb sense of short term. In my experience, there is one market I love for short term rentals.

Below you’ll see an Airbnb listing from-which is a great location for rental income, and for taking vacations – since it’s 15 mins to Clearwater Beach, FL. It’s a great house too, since it has the pool, putting green, pool table, etc. There is one problem with this location though-the neighbors aren’t keen about the Airbnb in their $700K+ neighborhood.

Long term, the risk to most Short Term rentals are neighborhood opposition. That often leads to the outlawing of such property uses through zoning restrictions. I’m not comfortable with this type of long term risk for short term cashflow.

Click to View this Florida Airbnb Listing

Which brings me to a better location for short term rentals – the Jersey Shore. I grew up outside of Philadelphia and there is no better feeling than rolling down the windows as you cross the bridge into any of the shore points and smell the Atlantic Ocean for the first time of the season. That feeling, that smell-THAT is summertime to most of us who’ve grown up on the East Coast.

The Jersey Shore includes most of the barrier islands along the coast going up to New York, but me, being from Philadelphia, think of this area as the Jersey Shore. Sorry Snookie-to me, “Jersey Shore” is NOT that TV show on MTV…

The reason I believe beach houses in NJ are a better location for short term rentals than Florida is that all of the neighbors already know what’s going on. People have been renting houses for a week at the shore FOREVER. No neighborhood opposition -it’s always been a Short Term rental town. There is near-zero risk of the towns outlawing short term rentals here.

Podcast Coming Soon: Redeveloping Dying Shopping Malls Part 2

This week I interviewed Saul Zenkevicius on the REI Diamonds Show. Saul is the founder of Z Equity Group, a commercial redevelopment firm currently focused on bring dead malls back to life. Saul is Rafik’s Partner-you might remember me mentioning Rafik last week. Saul runs the leasing machine which drives the value of Brait Fund & Z Equity Group by quickly leasing 200K-300K of Sq. Ft. every 6-12 months.

Saul & I were in business flipping houses in Miami back in 2017, but he graduated to very large industrial properties to obtain scale Saul actually invited me as his guest to the Commercial Academy back in 2022. I will attend the Cleveland event – August 23-25th. If you’d like to be my guest, please email me using the subject line “Commercial Academy”. Aside from ICSC, the Commercial Academy is one of the only places I know to meet commercial operators, developers, and even passive investors. The cost to attend is $897.

30,000 Sq. Ft Warehouse Deal for Sale – Memphis, TN

Interested in this deal? Call or Text Hannah Branham – 404-754-5829

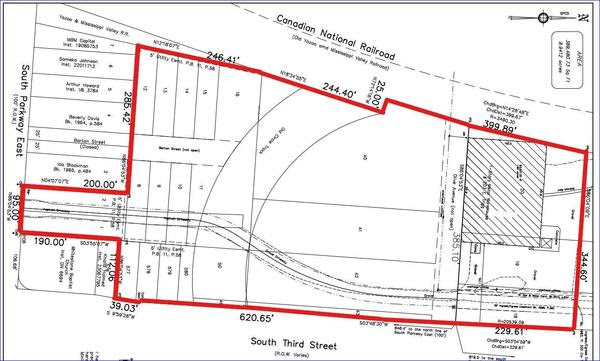

203 E. Trigg Road

Memphis, TN 38106

- 30,658 Sq. Ft. Warehouse

- Up to 8.94 Acres Available (Survey Below)

- Railroad Spur (currently buried, not in use)

- Zoned EMP (Industrial)

- Delivered Vacant at Closing

- Small 2nd Position Seller Financing Available

- Full Set of Photos

Price $1,275,000

This site is located in South Memphis along South 3rd Street (bottom left of photo) which is a raised roadway. This provides an element of privacy from the region while offering the potential for signage with 16,940 cars per day. This property offers nearly 5 acres of vacant & flat land which might be developed or used for Truck Parking or other Industrial Outdoor Storage.

203 E. Trigg Road, Memphis, TN 38106

Up to 8.94 Acres Available – Zoned EMP (Industrial)